metal material: the impact of tariffs trump

Introduction

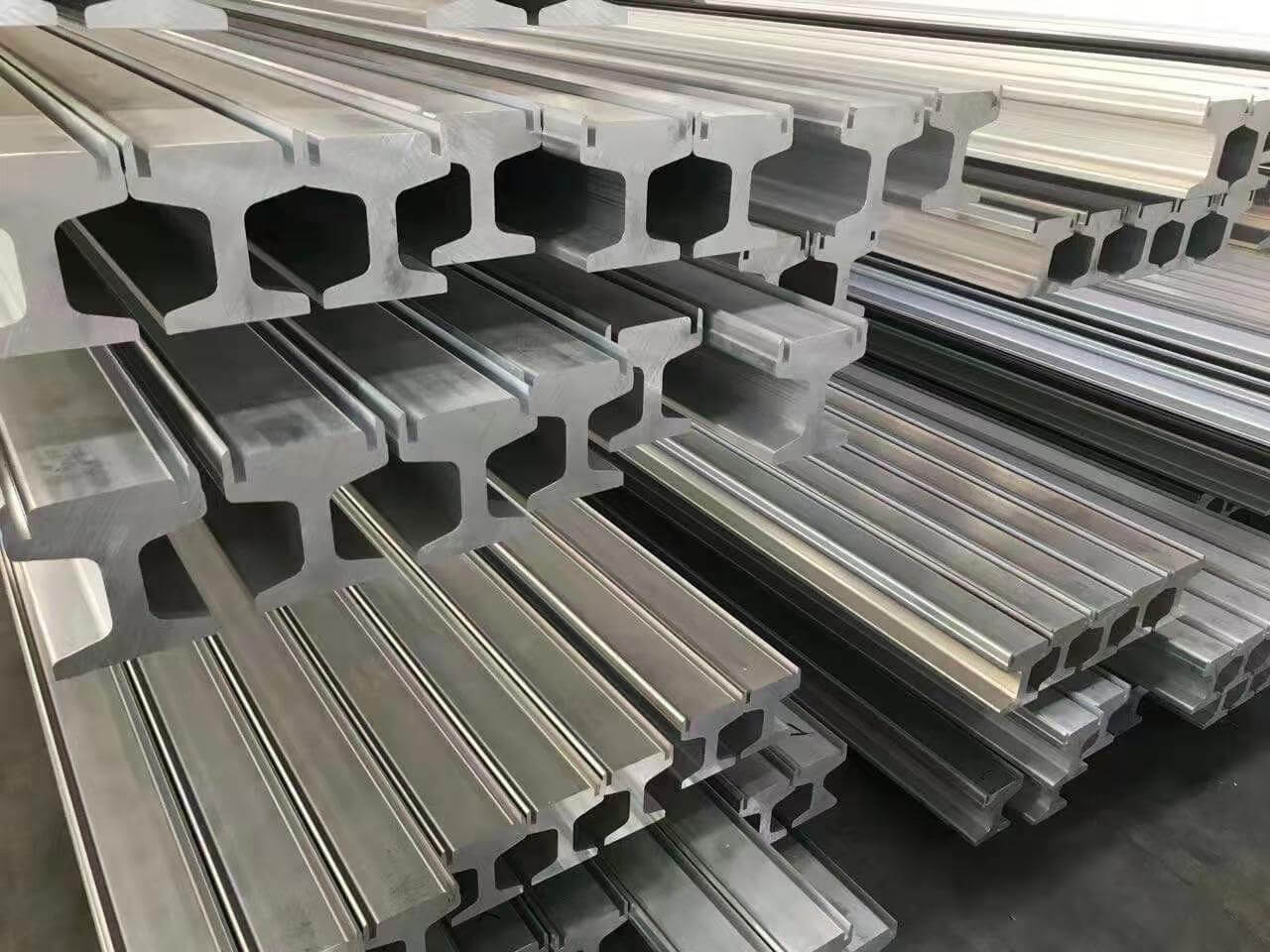

Tariffs are a powerful economic tool that can reshape the global market for metal materials. From aluminum sheet metal material to steel sheet metal material, these levies have far – reaching implications. In this article, we’ll explore how tariffs affect metal materials, influence their prices, and impact various industries.

Direct Effects of Tariffs on Metal Material

Cost Surge

When tariffs are imposed on metal materials, the most immediate impact is a cost surge. Take steel sheet metal material, for example. If a country slaps a 25% tariff on imported steel sheets, importers must pay a significant additional amount. This extra cost doesn’t vanish; instead, it gets passed along the supply chain. Manufacturers who rely on steel sheets for production face higher input costs. Similarly, aluminum sheet metal material isn’t spared. With increased tariffs, the cost of sourcing aluminum sheets rises, forcing companies to either absorb the cost or pass it on to consumers.

Supply Chain Disruptions

Tariffs also disrupt the supply chain of metal materials. Uncertainty about tariff policies makes it difficult for suppliers and buyers to plan. For instance, a sudden tariff hike might cause a shortage of aluminum sheet metal material as suppliers scramble to adjust. Some may even halt imports temporarily, waiting for clarity. These disruptions can lead to production delays for industries that depend on these materials.

Tariffs and Metal Material Price Fluctuations

Tariffs play a major role in the price fluctuations of metal materials. The price of steel sheet metal material can spike overnight due to a new tariff announcement. As importers factor in the extra cost, the market price for steel sheets soars. In the case of aluminum sheet metal material, price volatility becomes the norm. When tariffs change, suppliers may increase prices preemptively to protect their profits. On the other hand, buyers may hold off on purchases, hoping for a price drop. This tug – of – war between supply and demand, fueled by tariffs, creates a highly unstable pricing environment.

Industries Impacted by Tariffs on Metal Materials

Automotive Industry

The automotive industry is heavily reliant on both steel and aluminum sheet metal materials. Cars and trucks are built using large quantities of these metals. Higher tariffs mean that automotive manufacturers face increased production costs. To make up for this, they might raise the prices of vehicles, which could lead to reduced sales. Alternatively, they may cut costs elsewhere, potentially compromising on quality. In some cases, automakers may even shift production to regions with lower metal material tariffs.

Construction Industry

Steel sheet metal material is a staple in the construction industry. From building frames to roofing, steel is everywhere. Tariffs on steel can inflate construction costs significantly. Contractors may find it harder to bid on projects profitably. Delays in construction projects can also occur if the supply of steel sheets is disrupted due to tariffs. For aluminum sheet metal material, used in exterior cladding and window frames, tariff – induced price increases can add a substantial amount to building budgets.

Electronics Industry

The electronics industry uses aluminum sheet metal material for casings and heat sinks due to its lightweight and good heat – dissipation properties. Tariffs on aluminum can drive up the production costs of electronics. Manufacturers may be forced to either raise the prices of their products, making them less competitive, or find alternative, potentially lower – quality materials. This can have a cascading effect on the entire electronics supply chain.

Strategies for Mitigating the Impact of Tariffs

To counter the effects of tariffs on metal materials, companies have several strategies at their disposal. Some may seek out domestic suppliers of aluminum and steel sheet metal material to avoid import tariffs. Others might negotiate long – term contracts with existing suppliers to lock in prices. Investing in new technologies that reduce the reliance on certain metal materials is also an option. For example, some manufacturers are exploring alternative materials or innovative designs to use less steel or aluminum in their products.

Conclusion

Tariffs on aluminum and steel plates have far-reaching implications. From price increases to supply chain disruptions to industry-wide consequences, the implications are far-reaching. As the global trade landscape continues to evolve, companies and industries must remain vigilant and adapt their strategies to meet the challenges posed by tariff policies..